Definition of 'Insurance'

A contract (policy) in which an individual or entity receives financial protection or reimbursement against losses from an insurance company. The company pools clients' risks to make payments more affordable for the insured.

When shopping around for an insurance policy, look for the best priced package that is right for you - prices can vary from one insurance company to the next. And make sure you know what you want. Some individuals, for example, prefer 24-hour claims service or face-to-face contact with an insurance representative. Also consider the claims settlement process, the amount of the deductible and the extent of the replacement coverage. Insurance companies and the policies they offer are not all the same, so think about more than just the price.

Main article: History of insurance

Early methods[edit]

Methods for transferring or distributing risk were practiced by Chinese andBabylonian traders as long ago as the 3rd and 2nd millennia BC, respectively.[2] Chinese merchants travelling treacherous river rapids would redistribute their wares across many vessels to limit the loss due to any single vessel's capsizing. The Babylonians developed a system which was recorded in the famous Code of Hammurabi, c. 1750 BC, and practiced by earlyMediterranean sailing merchants. If a merchant received a loan to fund his shipment, he would pay the lender an additional sum in exchange for the lender's guarantee to cancel the loan should the shipment be stolen or lost at sea.

At some point in the 1st millennium BC, the inhabitants of Rhodes created the 'general average'. This allowed groups of merchants to pay to insure their goods being shipped together. The collected premiums would be used to reimburse any merchant whose goods were jettisoned during transport, whether to storm or sinkage.[3]

Separate insurance contracts (i.e., insurance policies not bundled with loans or other kinds of contracts) were invented in Genoa in the 14th century, as were insurance pools backed by pledges of landed estates. The first known insurance contract dates from Genoa in 1347, and in the next century maritime insurance developed widely and premiums were intuitively varied with risks.[4] These new insurance contracts allowed insurance to be separated from investment, a separation of roles that first proved useful in marine insurance.

Modern insurance[edit]

Insurance became far more sophisticated in Enlightenment era Europe, and specialized varieties developed.

Property insurance as we know it today can be traced to the Great Fire of London, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance "from a matter of convenience into one of urgency, a change of opinion reflected in Sir Christopher Wren's inclusion of a site for 'the Insurance Office' in his new plan for London in 1667".[5] A number of attempted fire insurance schemes came to nothing, but in 1681, economist Nicholas Barbon and eleven associates established the first fire insurance company, the "Insurance Office for Houses", at the back of the Royal Exchange to insure brick and frame homes. Initially, 5,000 homes were insured by his Insurance Office.[6]

At the same time, the first insurance schemes for the underwriting of business ventures became available. By the end of the seventeenth century, London's growing importance as a centre for trade was increasing demand for marine insurance. In the late 1680s, Edward Lloyd opened a coffee house, which became the meeting place for parties in the shipping industry wishing to insure cargoes and ships, and those willing to underwrite such ventures. These informal beginnings led to the establishment of the insurance market Lloyd's of London and several related shipping and insurance businesses.[7]

The first life insurance policies were taken out in the early 18th century. The first company to offer life insurance was the Amicable Society for a Perpetual Assurance Office, founded in London in 1706 by William Talbot and Sir Thomas Allen.[8][9] Edward Rowe Mores established the Society for Equitable Assurances on Lives and Survivorship in 1762.

It was the world's first mutual insurer and it pioneered age based premiums based on mortality rate laying “the framework for scientific insurance practice and development” and “the basis of modern life assurance upon which all life assurance schemes were subsequently based”.[10]

In the late 19th century, "accident insurance" began to become available. This operated much like modern disability insurance.[11][12] The first company to offer accident insurance was the Railway Passengers Assurance Company, formed in 1848 in England to insure against the rising number of fatalities on the nascentrailway system.

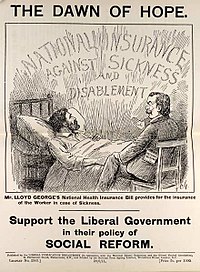

By the late 19th century, governments began to initiate national insurance programs against sickness and old age. Germany built on a tradition of welfare programs in Prussia and Saxony that began as early as in the 1840s. In the 1880s Chancellor Otto von Bismarck introduced old age pensions, accident insurance and medical care that formed the basis for Germany's welfare state.[13][14] In Britain more extensive legislation was introduced by the Liberal government in the 1911 National Insurance Act. This gave the British working classes the first contributory system of insurance against illness and unemployment.[15] This system was greatly expanded after the Second World War under the influence of the Beveridge Report, to form the first modern welfare state.[13][16]

Principles[edit]

Insurance involves pooling funds from many insured entities (known as exposures) to pay for the losses that some may incur. The insured entities are therefore protected from risk for a fee, with the fee being dependent upon the frequency and severity of the event occurring. In order to be an insurable risk, the risk insured against must meet certain characteristics. Insurance as a financial intermediary is a commercial enterprise and a major part of the financial services industry, but individual entities can also self-insure through saving money for possible future losses.[17]

Insurability[edit]

Main article: Insurability

Risk which can be insured by private companies typically shares seven common characteristics:[18]

- Large number of similar exposure units: Since insurance operates through pooling resources, the majority of insurance policies are provided for individual members of large classes, allowing insurers to benefit from thelaw of large numbers in which predicted losses are similar to the actual losses. Exceptions include Lloyd's of London, which is famous for insuring the life or health of actors, sports figures, and other famous individuals. However, all exposures will have particular differences, which may lead to different premium rates.

- Definite loss: The loss takes place at a known time, in a known place, and from a known cause. The classic example is death of an insured person on a life insurance policy. Fire, automobile accidents, and worker injuries may all easily meet this criterion. Other types of losses may only be definite in theory. Occupational disease, for instance, may involve prolonged exposure to injurious conditions where no specific time, place, or cause is identifiable. Ideally, the time, place, and cause of a loss should be clear enough that a reasonable person, with sufficient information, could objectively verify all three elements.

- Accidental loss: The event that constitutes the trigger of a claim should be fortuitous, or at least outside the control of the beneficiary of the insurance. The loss should be pure, in the sense that it results from an event for which there is only the opportunity for cost. Events that contain speculative elements, such as ordinary business risks or even purchasing a lottery ticket, are generally not considered insurable.

- Large loss: The size of the loss must be meaningful from the perspective of the insured. Insurance premiums need to cover both the expected cost of losses, plus the cost of issuing and administering the policy, adjusting losses, and supplying the capital needed to reasonably assure that the insurer will be able to pay claims. For small losses, these latter costs may be several times the size of the expected cost of losses. There is hardly any point in paying such costs unless the protection offered has real value to a buyer.

- Affordable premium: If the likelihood of an insured event is so high, or the cost of the event so large, that the resulting premium is large relative to the amount of protection offered, then it is not likely that the insurance will be purchased, even if on offer. Furthermore, as the accounting profession formally recognizes in financial accounting standards, the premium cannot be so large that there is not a reasonable chance of a significant loss to the insurer. If there is no such chance of loss, then the transaction may have the form of insurance, but not the substance (see the U.S. Financial Accounting Standards Board pronouncement number 113: "Accounting and Reporting for Reinsurance of Short-Duration and Long-Duration Contracts").

- Calculable loss: There are two elements that must be at least estimable, if not formally calculable: the probability of loss, and the attendant cost. Probability of loss is generally an empirical exercise, while cost has more to do with the ability of a reasonable person in possession of a copy of the insurance policy and a proof of loss associated with a claim presented under that policy to make a reasonably definite and objective evaluation of the amount of the loss recoverable as a result of the claim.

- Limited risk of catastrophically large losses: Insurable losses are ideally independent and non-catastrophic, meaning that the losses do not happen all at once and individual losses are not severe enough to bankrupt the insurer; insurers may prefer to limit their exposure to a loss from a single event to some small portion of their capital base. Capital constrains insurers' ability to sell earthquake insurance as well as wind insurance inhurricane zones. In the United States, flood risk is insured by the federal government. In commercial fire insurance, it is possible to find single properties whose total exposed value is well in excess of any individual insurer's capital constraint. Such properties are generally shared among several insurers, or are insured by a single insurer who syndicates the risk into the reinsurance market.

More read:http://en.wikipedia.org/wiki/Insurance

No comments:

Post a Comment

Thanks for visit....